The Next Era of

Smart Protection

The Challenge

The industry faces pressure from rising customer expectations, increasingly complex risks, and high operational costs from manual processes.

The AI Opportunity

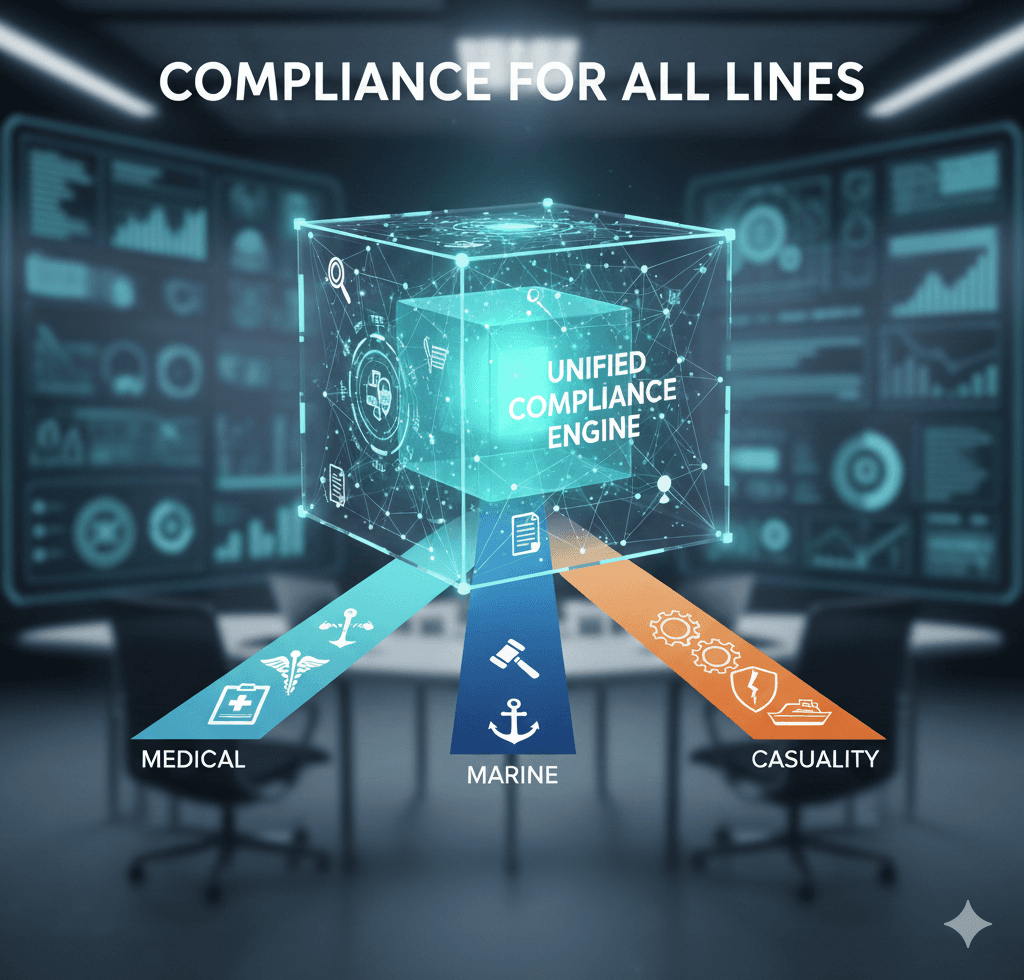

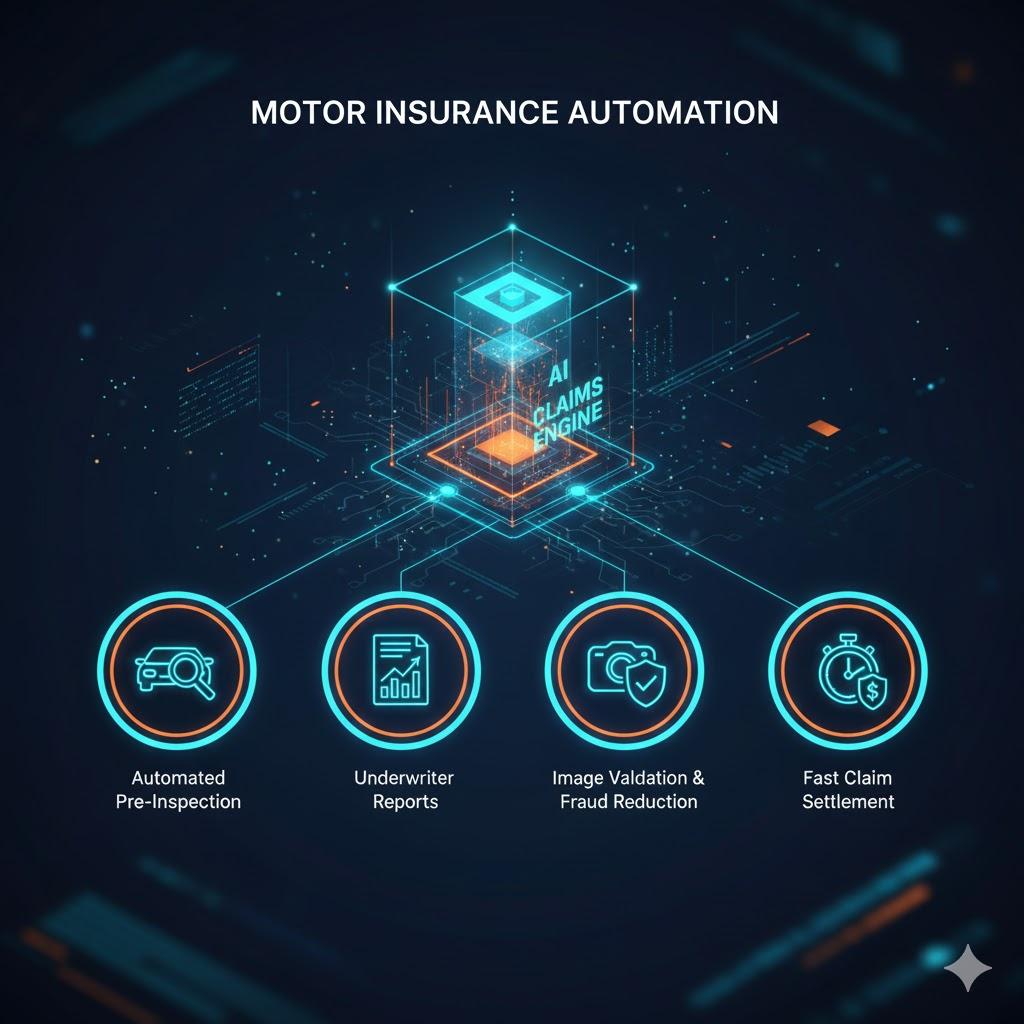

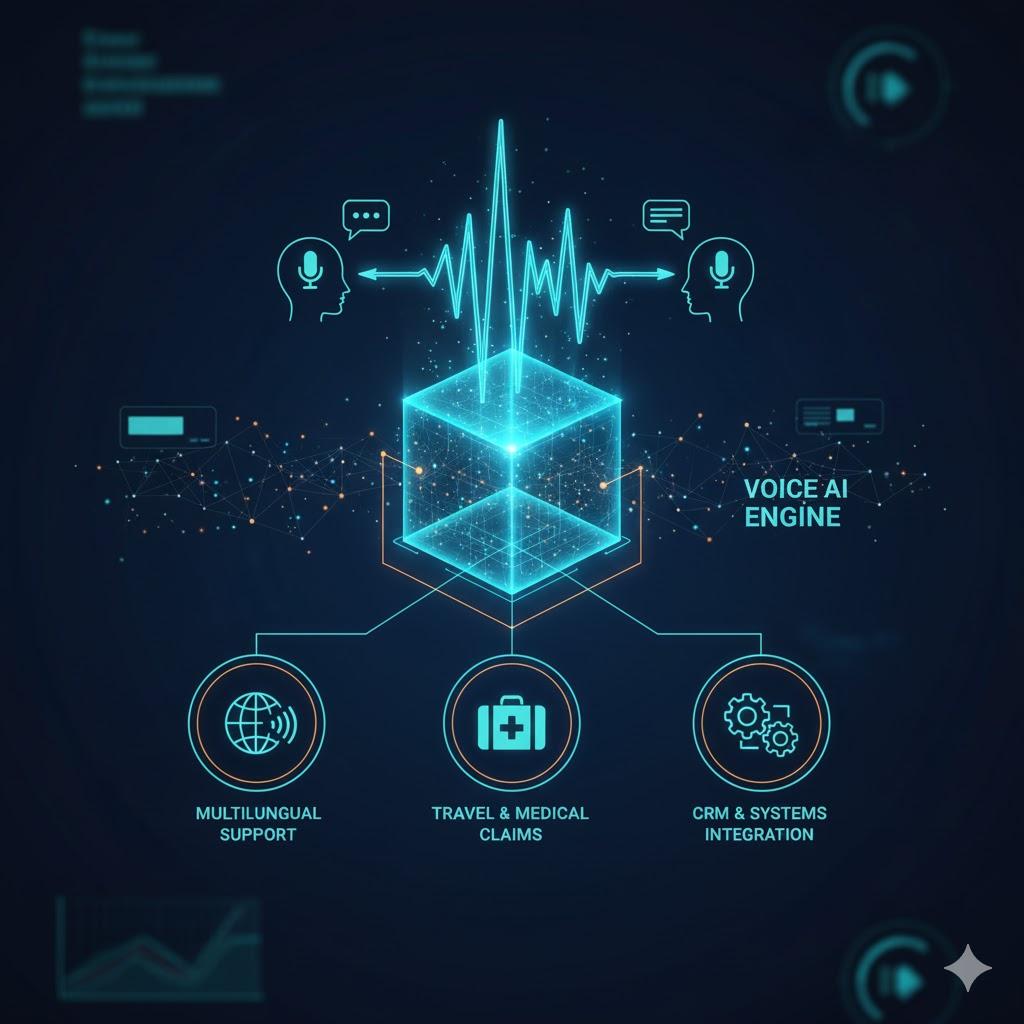

AI provides the key to move from a traditional "react and repair" model to a modern "predict and prevent" framework.

- Automate complex, repetitive tasks at scale.

- Uncover hidden risks and fraud patterns.

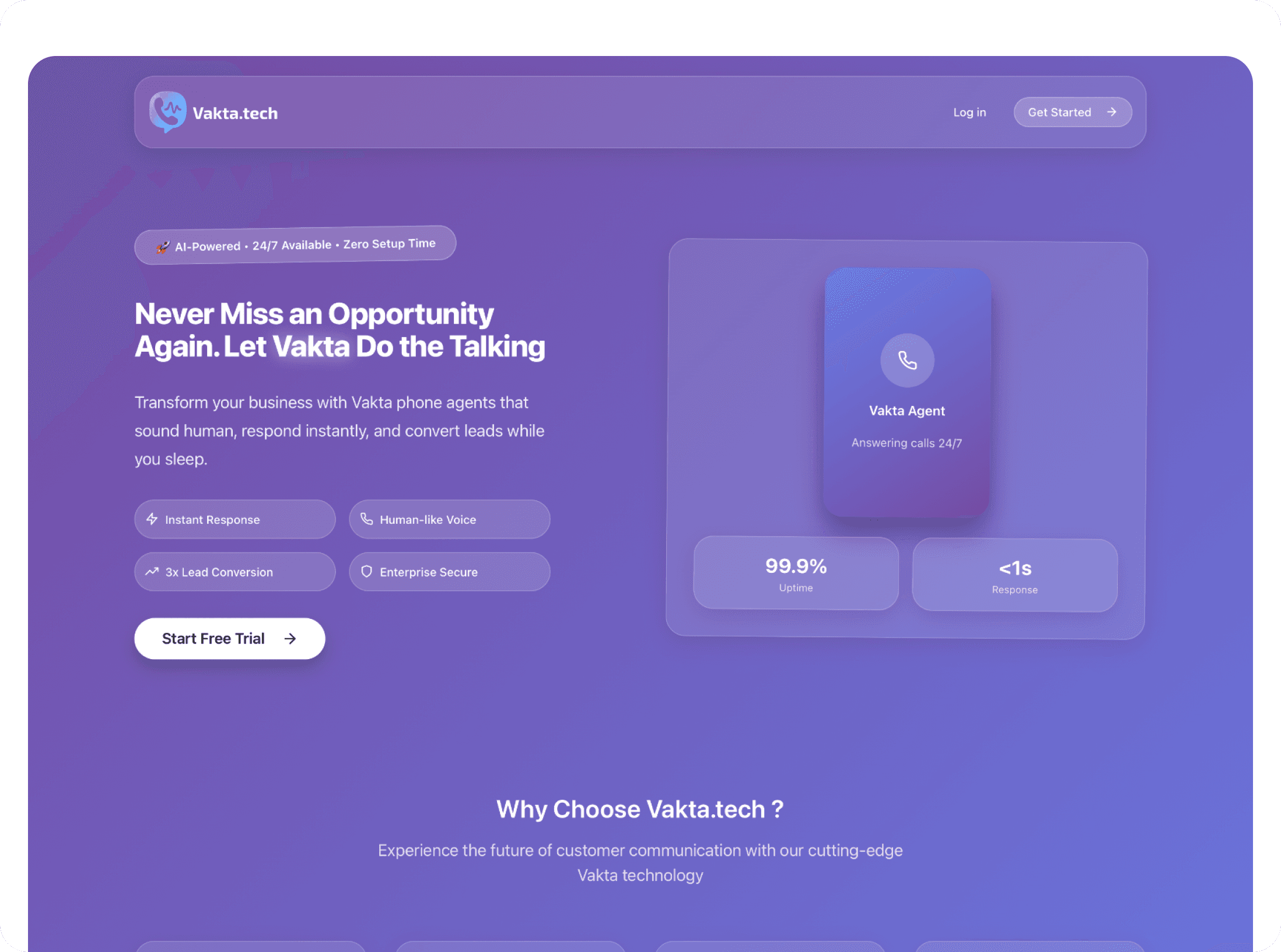

- Deliver personalized, instant customer experiences.